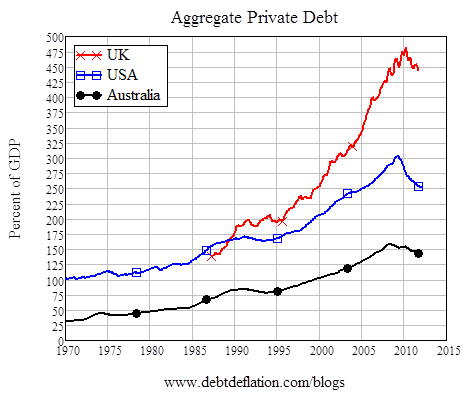

He managed to gather the data for aggregate private debt in the US and Australia and drew the result in the chart below:

There was a debt bubble in the 30s which led to the great depression, and now it appears we have the same kind of bubble, only more pronounced. The main difference is that now we live in a world of fiat currencies and what happens next is highly depending on monetary policies.

I encourage you to read his blog post for details about private debt. I'm going to focus on 2 scenarios:

- Deflation where the central banks do not really fight the debt deflation (or debtflation).

- Inflation where the central banks decide to keep the aggregate private debt constant and works thru the years via inflation.

In this scenario, there would be massive deflation, and, in theory, the preferred asset would be cash (under the mattress) and many companies and banks would have to go bankrupt, but in reality, the system would probably have to collapse, and I'm not so sure what the value of cash would be. This is the kind of scenario envisioned by Robert Prechter who sees the Dow Jones at 1000 USD.

The other scenario (flat private debt to GDP ratio) would assume massive money printing. Let's assume somehow the federal reserve can keep this ratio constant by printing money during 23 years. If the GDP growth is flat, it would require about 3% (extra) inflation per year. However, during that period, there is actually a good chance of negative growth because Peak oil consequences will be in full effect unless we find some energy alternatives. This also excludes public debt and unfunded liabilities (about 100 trillions USD or 600% of GDP) which would require inflation north of 10% to get monetized.

If you think the US is in bad shape, just look at the aggregate private debt in the UK in the chart below. This country (and the British pound) are going to have a very rough time in the years and even decades ahead, as its private debt stands at 450% of GDP.

You may also want to read "Currency Crisis:Why is the British Pound a doomed currency ?" for a more detailed analysis of the United Kingdom debt and upcoming GBP currency crisis.

No comments:

Post a Comment