As we covered previously, there are plenty of metrics screaming the US stock market is in lalaland as one of the most overvalued markets (even before COVID-19), a complete disconnect between the economy and the stock market with the Wilshire 5000 to GDP ratio - aka Buffet Indicator - expected to reach around 230% by the end of July with the first Q2 GDP numbers.

When we asked whether the stock market rally was over on May 3rd, we noted the 1929 stock market rally took several months and our 1929 Redux simulation would take to it to May/June. We also pointed out one metric suggested it may have more legs: the AAII sentiment survey, or the bullishness/bearishness of the retail investor. We did not look into it too much at the time, so let's do that today by first looking at a 1998 to 2015 chart of the AAII bullishness 8-week moving average data courtesy of investing.com.

We can see every time the chart sharply drops below 25% it has been a buying opportunity. If you don't quite remember what the S&P 500 looks like for the period I have reproduced it below...

There were plenty of times when the ratio went under 30% between 1988 and 1994, and if you had purchased stock during that period you would have done well. Same thing for 2003 and 2009. In 2015, stocks may have looked overpriced, but the index was at around 2,000 points, and in May 31, 2020, the index is priced at around 3,000 or a 50% gain.

So what does the 8-week moving average of the AAII bullish sentiment index looks like today? Ycharts provides a free 5-year chart updating weekly for use to check.

At the time of the 2016 presidential election, the index was at 25%, a buying opportunity based on this index. But at the time, I was personally really wary of buying US stocks considering the length of the bull market, and other metrics.

What about today? The index stands at 29.50%, so retail investors are fairly bearish although not extremely so. Almost everything else cries "sell!!!", but the AAII sentiment survey tells me to wait a little longer, or strangely enough there should even be a buying opportunity, but I'd like to give it a pass.

Also, remember that's a presidential election year in the US, so politicians in power won't be shy to spend money they don't have, as we've seen in recent months in order to keep the system going, and are greatly helped with the federal reserve with their unlimited buying power. Could they just throw enough money at the system to keep it going for 5 more months until the election? I don't know but would not rule out the possibility.

While AAII sentiment survey looks useful to spot buying opportunity, it does not seem to be a good timing indicator for selling stocks. In 2000, it works, but was completely useless for the 2007 peak, and would have made people sell their stocks later in 2004, and in 2011 with bull markets in their early stages.

Sunday, May 31, 2020

Sunday, May 24, 2020

People behind Brookfield Investment Funds Plc and Kaloca Inc Investment Fraud

Somehow, the scammers are still free to operate but at least the Financial Conduct Authority in the UK and Ireland has finally written warnings about Brookfield Investment Funds Plc "clone firm" that mislead investors by claiming to be an already authorized firm.

|

| Derek Nguyen - Kaloca Inc. CEO |

Amazingly Kaloca Inc. company has been registered by a recidivist, Mr. Derek Nguyen, who previously another scam company under the name Kaloca Holdings Inc. He is now CEO at Kaloca Inc, and both companies point to the same, non-loading website kaloca dot com.

Based on investigative work, Brookfield scammers are mostly working out of Northern Virginia with Carl Bryce likely being a scammer on the West Coast, and others are using fake names. Gregory Ellis, who is allegedly working with them, had been arrested in Thailand in 2013, then jailed by the DOJ, but was eventually released from prison and went back to his old trade.

While the walls are closing in on the scammers, various authorities are involved, victims are often taken in a circular loop, where each agency point to the other one to solve the issue. We'll keep you posted if more information comes out. Feel free to contact us if you are a victim, as if more people come together there's a better change to recover the funds.

Sunday, May 17, 2020

US Market Cap to GDP Forecast: 230% in Q2 2020

In our April 19 post entitled "All is Well! FAANG Stocks Hit All Times High as the Economy Collapses", we noted incredible disparities between the economy and the market. One of the metrics we used was the US market cap to GDP, aka the Buffet Indicator, which gives a sense of the valuation of the overall stock market (Willshire 5000) against the economy as measured by the GDP.

It was around 130& at the time, a level considered to represent an overvalued stock market, with 80% being fair-valued. As the stock market continued recovering, and the GDP "only" dropped by 4.8% in Q1 2020 for a total of 21.54 trillion dollars annualized, the ratio became slightly worse, and today it is at about 134%.

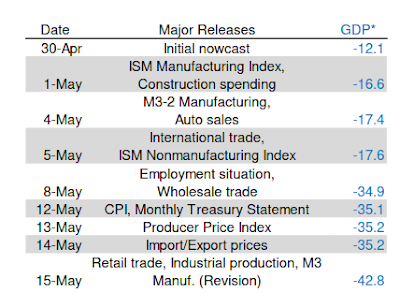

But once numbers for Q2 2020 come out, there will need to be adjustments. Either the stock market lowers to keep the ratio realistic, or it ignored the news, and the market cap to GDP goes to lalaland at levels never seen before... So what kind of scenario may happen? To find out we'll take the more recent Atlanta Fed GDPNow forecast for Q2 2020.

That would be a 42.8% drop (annualized). So If I understand correctly, we'd take the 21.54 trillion dollars mentioned in the introduction, and deduct 42.8% for it. Total: 12.32 trillion dollars or about the same amount of 2004 GDP.

Now that looks really bad, but it should also be temporary with massive jumps in GDP in Q3 and Q4 2020. If we get back to 18+ trillion dollars that would be a ~50% GDP growth over two quarters. Still significantly lower than previously, but that should allow some politicians to boast about economic performance...

What would that do to the US market cap to GDP ratio, if stocks were to stay at the current levels? We already have the estimated GDP (12.32 trillion), so we need the Wilshire 5000 market cap that is 28.77 trillion (courtesy of Ycharts).

That a cool ratio of 233% market cap to GDP... Let's represent this on a chart...

Beautiful! Although it's temporary, as it will come down as GDP eventually increases significantly once economies reopen.

Let's look at scenario two, where stocks magically adjust to the new GDP number. That one may not be quite realistic because markets are supposed to adjust themselves to future outcomes, although the markets have not been very good at it. But anyway, a 134% ratio would mean the Wilshire 5000 would drop from 28.77 trillion to 16.50 trillion, or a 42.6% drop.

Since most people don't follow the Wilshire 500, let's apply the 42.6% drop to the S&P 500 index at 2,863.70 points on May 15. That would make it drop to 1,643 points.

Q2 2020 GDP first official estimate is supposed to be released in July 2020, hence the strange shape of our chart. Note at 134% TCM to GDP, the stock market would be vastly overvalued if we ignore future GDP growth.

But let's take a more realistic scenario that assumes the Federal Reserve does not completely go crazy with the money supply. We would get back to 18 trillion GDP, with a fairly valued stock market (and fairly pessimistic investor sentiment) at 80% of GDP. In this case, the Wilshire 5000 would have a market capitalization of 14.4 trillion dollars. That's even lower than our case above but spread over a longer period of time. Where would be the S&P 500 then, let's say in H1 2021? That's roughly a 50% drop, meaning the S&P 500 would be around 1,430 points, the Dow Jones under 12,000. I think you get the point, no chart needed...

Happy investing, and good luck!

It was around 130& at the time, a level considered to represent an overvalued stock market, with 80% being fair-valued. As the stock market continued recovering, and the GDP "only" dropped by 4.8% in Q1 2020 for a total of 21.54 trillion dollars annualized, the ratio became slightly worse, and today it is at about 134%.

But once numbers for Q2 2020 come out, there will need to be adjustments. Either the stock market lowers to keep the ratio realistic, or it ignored the news, and the market cap to GDP goes to lalaland at levels never seen before... So what kind of scenario may happen? To find out we'll take the more recent Atlanta Fed GDPNow forecast for Q2 2020.

That would be a 42.8% drop (annualized). So If I understand correctly, we'd take the 21.54 trillion dollars mentioned in the introduction, and deduct 42.8% for it. Total: 12.32 trillion dollars or about the same amount of 2004 GDP.

Now that looks really bad, but it should also be temporary with massive jumps in GDP in Q3 and Q4 2020. If we get back to 18+ trillion dollars that would be a ~50% GDP growth over two quarters. Still significantly lower than previously, but that should allow some politicians to boast about economic performance...

What would that do to the US market cap to GDP ratio, if stocks were to stay at the current levels? We already have the estimated GDP (12.32 trillion), so we need the Wilshire 5000 market cap that is 28.77 trillion (courtesy of Ycharts).

That a cool ratio of 233% market cap to GDP... Let's represent this on a chart...

Beautiful! Although it's temporary, as it will come down as GDP eventually increases significantly once economies reopen.

Let's look at scenario two, where stocks magically adjust to the new GDP number. That one may not be quite realistic because markets are supposed to adjust themselves to future outcomes, although the markets have not been very good at it. But anyway, a 134% ratio would mean the Wilshire 5000 would drop from 28.77 trillion to 16.50 trillion, or a 42.6% drop.

Since most people don't follow the Wilshire 500, let's apply the 42.6% drop to the S&P 500 index at 2,863.70 points on May 15. That would make it drop to 1,643 points.

Q2 2020 GDP first official estimate is supposed to be released in July 2020, hence the strange shape of our chart. Note at 134% TCM to GDP, the stock market would be vastly overvalued if we ignore future GDP growth.

But let's take a more realistic scenario that assumes the Federal Reserve does not completely go crazy with the money supply. We would get back to 18 trillion GDP, with a fairly valued stock market (and fairly pessimistic investor sentiment) at 80% of GDP. In this case, the Wilshire 5000 would have a market capitalization of 14.4 trillion dollars. That's even lower than our case above but spread over a longer period of time. Where would be the S&P 500 then, let's say in H1 2021? That's roughly a 50% drop, meaning the S&P 500 would be around 1,430 points, the Dow Jones under 12,000. I think you get the point, no chart needed...

Happy investing, and good luck!

Sunday, May 3, 2020

May 2020 - Is the Bear Market Rally Over?

When we discussed whether 2020 might be the Great Depression of 1929 All Over Again on March 22, 2020, we applied the monthly Dow Jones chart variations of 1929 to the chart 2020 and noticed there may be a rebound soon.

and the market indeed started to rally almost immediately, then we thought we might get back to around 23,000 points by May/June, and plateau there for a while...

We've gone beyond that level to almost 25,000 now as shown by the 3-month daily until May 1st. So it might be a good time checking out technicals again, as we all know fundamentals look horrible.

The red line above corresponds to the 61.8% Fibonacci retracement, a bearish technical indicator that could indicate the bear market rally may be over, and we may at least re-test the low.

If we look at the 14-day relative strength index (RSI-14), we can see a top at 59.76 on April 29, not quite oversold just yet, but close to the level we were on February 18, 2020 top (RSI-14 = ~65).

Individual investors are not overly bullish and stay bearing on aggregate with a -13.43% bull-bear spread, which means this rally may last a bit longer.

In "normal times", I'd have no problem shorting this market, but with Central bank involvement we simply don't know where's it's going. The BOJ (Bank of Japan) has been printing money for years, and it has not helped their market a bit, but if we turn our eyes on Venezuela, and the Caracas market, money printing does work... when it comes to boosting the stock market.

That's over ten times return on investment over one year, and 210.94% since the beginning of 2020 in local currency... But the Venezuelan Bolívar crashed compared to the US Dollar, and the country is suffering from hyperinflation, something that's highly unlikely in developed economies in the short term, but not completely impossible over the long term depending on central banks actions.

We still favor "sell in May and go away" for the S&P 500, Dow Jones, and most markets around the world.

|

| 2020 Redux of 1929 Dow Jones chart |

and the market indeed started to rally almost immediately, then we thought we might get back to around 23,000 points by May/June, and plateau there for a while...

We've gone beyond that level to almost 25,000 now as shown by the 3-month daily until May 1st. So it might be a good time checking out technicals again, as we all know fundamentals look horrible.

The red line above corresponds to the 61.8% Fibonacci retracement, a bearish technical indicator that could indicate the bear market rally may be over, and we may at least re-test the low.

If we look at the 14-day relative strength index (RSI-14), we can see a top at 59.76 on April 29, not quite oversold just yet, but close to the level we were on February 18, 2020 top (RSI-14 = ~65).

Individual investors are not overly bullish and stay bearing on aggregate with a -13.43% bull-bear spread, which means this rally may last a bit longer.

In "normal times", I'd have no problem shorting this market, but with Central bank involvement we simply don't know where's it's going. The BOJ (Bank of Japan) has been printing money for years, and it has not helped their market a bit, but if we turn our eyes on Venezuela, and the Caracas market, money printing does work... when it comes to boosting the stock market.

That's over ten times return on investment over one year, and 210.94% since the beginning of 2020 in local currency... But the Venezuelan Bolívar crashed compared to the US Dollar, and the country is suffering from hyperinflation, something that's highly unlikely in developed economies in the short term, but not completely impossible over the long term depending on central banks actions.

We still favor "sell in May and go away" for the S&P 500, Dow Jones, and most markets around the world.

Subscribe to:

Comments (Atom)